Economics is a complex science and as such has different branches and concepts. One of them is quite interesting since it goes against the grain with respect to classical economic ideas. We talk about behavioral economics.

Unlike what most economists believed until relatively recently, human beings are not rational beings, even in their economic decision-making. People buy, sell and carry out other financial transactions with our reason clouded by our desires and emotions.

On many occasions the behavior of the markets, directly dependent on the behavior of consumers and investors, cannot only be explained with classical economics, but rather with psychology, and Behavioral economics is the intermediate point between both disciplines Let’s see it below.

What is behavioral economics?

Behavioral economics, also called behavioral economics, is a branch of knowledge that combines aspects of economic sciences, such as microeconomics, with psychology and neuroscience This science maintains that financial decisions are not the result of rational behavior, but rather the product of the irrational impulses of consumers and investors. Economic phenomena occur as a consequence of various psychological, social and cognitive factors which affect our decision-making and, consequently, the economy.

The main premise of behavioral economics goes against classical ideas in economics. Traditionally, economics defended that human beings behaved rationally in terms of economic movements, buying, selling and investing in a completely thoughtful manner. Behavioral economics maintains that markets do not move solely based on rational algorithms but rather allows itself to be influenced by the cognitive biases of buyers and investors, because at the end of the day they are people and like any other, their behavior is manipulated in one way or another.

Thus, behavioral economics maintains that the market and its associated phenomena must be studied and interpreted based on human behavior, understood in its most psychological sense. Human beings do not stop having desires, feelings, emotions, preferences and biases which do not disappear when we enter a supermarket, invest in the stock market or sell our house. Our decisions will never be free of our mental states.

It is taking all this into account that behavioral economics is interested, above all, in understand and explain why individuals behave in a different way than had been hypothesized with classical economic models in hand If people were as rational as traditional economic positions hold, financial movements and phenomena should be more easily predictable, only fluctuating depending on environmental problems such as lack of resources in a certain material or diplomatic conflicts.

Historical background

As surprising as it may seem, From its beginnings, economics was connected with psychology In the treatises of the famous economists Adam Smith and Jeremy Bentham, some relationships are established between economic phenomena and the behavior of human beings, seen as something that can hardly be classified as something totally rational and predictable. However, neoclassical economists distanced themselves from these ideas, trying to find explanations for market behavior in nature.

It would not be until the 20th century that these conceptions about how irrational human beings are and how their biases, emotions and desires influence the behavior of the large market would be resumed. In the middle of that century, the role of human psychology in economic decision-making was taken into consideration again leaving aside the fact that human beings reflexively consider what they buy and what they sell, at what price or if it is worth doing so.

In 1979, what is considered the most relevant text in behavioral economics, “Prospect theory: Decision Making Under Risk”, by Daniel Kahneman and Amos Tversky, was published. In this book, both authors try to demonstrate how the knowledge of behavioral sciences, especially cognitive and social psychology, allows us to explain a series of anomalies that have occurred in what is called rational economics.

Assumptions of behavioral economics

There are three main assumptions that define behavioral economics:

behavioral economics calls this satisfaction in the purchase of products and services as “utility” While in traditional macroeconomics it is established that people make economic decisions to maximize utility, using all the information of which they have knowledge, in behavioral theory it is defended that individuals do not have preferences or standard beliefs, nor that their decisions are standardized. Their behavior is much less predictable than previously believed and, therefore, it is not possible to predict which product they are going to buy, but it is possible to influence their choice.

Behavioral economics according to Daniel Kahneman

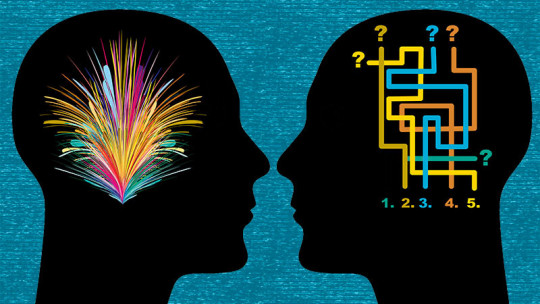

As we have mentioned, one of the key figures of behavioral economics is Daniel Kahneman, who won the Nobel Prize in Economics in 2002 thanks to his studies on the complexity of human thought applied to the behavior of markets. Among his best-known books we have “Thinking Fast, Thinking Slowly” a text in which he presents a theory about the two cognitive systems that coexist in our brain.

The first of these systems is intuitive and impulsive, which leads us to make most decisions in daily life. This system is the one that is influenced by fears, illusions and all kinds of cognitive biases. The second system is more rational, responsible for analyzing the intuitions of the first system to make decisions based on them. According to Kahneman, both systems need each other, but they have problems maintaining balance, which is necessary to be able to make good decisions.

Behavioral economics according to Richard Thaler

Another of the modern figures of behavioral economics is Richard Thaler, who won the Nobel Prize in economics in 2017 with his nudge theory. In his theoretical proposal maintains that human beings are not always prepared or capable of making the decisions that best suit them and that is why sometimes we need a little push to decide, whether making a correct decision or one that is not.

To understand Thaler’s nudge theory, let’s imagine that we are in a supermarket. We have been forward-looking and we have made a shopping list and we try to go for the products directly, trying to focus on what we have come to buy. However, upon entering the establishment we see a large sign at the entrance showing a 2 for 1 offer on chocolate bars, something that we did not want and should not buy but, upon seeing that advertisement, we decided to include it in the cart.

Even though we had the shopping list made in advance, which did not include those chocolate bars, seeing that they were on sale gave us that little push to buy them, even knowing that we didn’t need them. If, for example, they had not indicated that they were on sale but had sold the tablets at the same price they cost us, we would surely not have even stopped to think about going to buy them and, rationally, we would have avoided purchasing them as they were off the list.

homo economicus

Another of Richard Thaler’s valuable contributions to the field of behavioral economics is found in homo economicus or “econ”, which is the equivalent of the “buyer persona” in the world of marketing. Thaler presents this imaginary hominid to us as the idea of the client to whom a certain product or service is directed, that is, the ideal prototypical buyer that was thought of when that object or service was designed.

Thaler indicates that practically since the founding of the economy, the buyer/investor has been seen as a being who obeys only and exclusively logical and rational criteria, as we have mentioned before. Classical economics wrongly assumes that human beings put aside their wills, fears, socioeconomic conditions or risk profile when they were engaged in any economic activity, as if suddenly their subjectivity disappeared and it was pure rationality.

Richard Thaler has stated that this is not even remotely the case. In fact, the reasons why he has been awarded the Nobel Prize are to have discovered the limitations of supposed human rationality in economic decision making demonstrate that our senses deceive us, just as happens with optical illusions, and that biases influence our way of buying and selling.

Psychological phenomena and economic decision making

As we said, human decision-making does not respond solely to rational criteria and these decisions are not separated from subjectivity when they are made in situations related to the economy, such as the purchase and sale of products and services. Next we are going to see some phenomena that occur in economic decision making.

1. Avalanche of information

The average consumer is exposed to many options and features when choosing a service or product So much variety can confuse you, receiving a veritable avalanche of information that causes you to choose at random or even get blocked and not make any decision.

2. Heuristics

Many times consumers They take shortcuts in their decisions to avoid having to evaluate products or do research about which is the best Thus, for example, instead of analyzing all the products, they limit themselves to buying the same thing that their friends or family have bought, or they let themselves be influenced by what they first saw advertised on television or in other media.

3. Fidelity

Although there are better, newer or more popular products, it usually happens that consumers tend to be loyal to the products or services they were already consuming. They are reluctant to change suppliers or brands for fear of making a mistake. Here the principle of “better bad known than good not known” would apply.

4. Inertia

Consumers generally do not change products or suppliers if it means having to invest a little effort and leave their comfort zone. There is a time when once we have become accustomed to our lifelong product or service, we end up consuming it again without thinking about changing it or even considering it.

5. Frame

The consumers They are influenced by the way the service or product is presented to them Things as simple as the packaging, the colors, the location of the product on the shelves or the prestige of the brand are enough for us to decide to buy a product whose quality-price ratio is quite poor.

We have an example of this in cocoa cookies with cream, cookies that all supermarkets sell with their own private label and also the commercial brand version. Whether we buy white label ones from any supermarket or if we buy the same ones advertised on TV, we are buying exactly the same cookies, since they are made with the same ingredients and with the same process, only changing the shape and packaging a little. .

According to classical economics, as consumers we would all end up buying the cookies that are sold at the lowest price or whose quantity-price works for us since, at the end of the day, the quality of all cookies is the same. However, this is not the case, as the commercial brand (which the reader is sure to think about right now) is the one with the most sales. The simple fact of being on TV and having more “prestige” makes us prefer that brand.

6. Risk aversion

Consumers would rather avoid a loss than gain something which is why they are also less in favor of changing services or products even if they have reviews that indicate that that one is better.