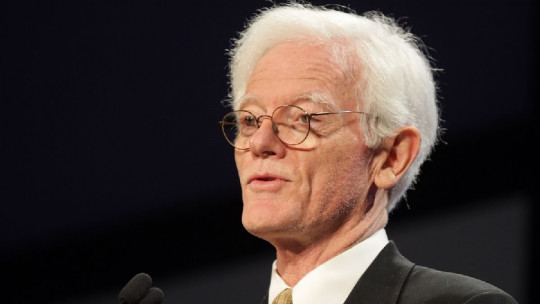

William A. Ackman, better known as Bill Ackman, is a hedge fund manager. He has earned an important position as an investor thanks to the founding of his hedge company, Pershing Square Capital Management.

If you are interested in knowing his way of thinking and philosophy of life, this compilation of the best quotes from Bill Ackman you will be interested.

The most memorable and motivating Bill Ackman quotes

In this article we will see a selection of quotes and thoughts from Bill Ackman about finances and life in general.

1. You can learn how to invest by reading books.

According to Ackman, this is an easy career to learn.

2. I was a bit of a stuck-up kid.

Recognizing his egocentrism as a young man.

3. I am not emotional about investments.

For this world, it is necessary to keep a cool mind.

4. I am always prepared to do the right thing no matter what others think.

Hold on to your values and seek to do the right thing.

5. I am an extremely, extremely persistent person. Extremely.

Persistence helps us thrive.

6. Investing is a business where you can look very foolish for a long period of time before you are proven right.

It must be remembered that investment gains are seen in the long term.

7. Short-term economic and market forecasting is largely nonsense.

It is almost impossible to measure the prosperity of the economic market in a short time.

8. To be successful, you need to make sure that being rejected doesn’t bother you at all.

Failure is part of the pursuit of success.

9. I love what I do. I don’t do it for the money.

When we do what we love, we are able to cope with different situations.

10. I have seen very few people in the world achieve anything unless they are optimistic.

Negativity leads us to a point of stagnation, instead of growth.

11. In the investment business you need a high degree of confidence, but you also need a high degree of humility and you have to balance those two…

It is necessary to keep your feet on the ground to avoid falling into a point of no return.

12. Everyone told me it was a really stupid idea to start my own hedge fund right after business school. That’s how I knew it was a good idea.

A great way to use negative reviews as motivation to emerge.

13. I believe that good private equity investors create much more economic value than they destroy.

Reflections on the contribution of private investors.

14. What I love about tennis is that I am better now than when I was 20 years old.

Time helps us perfect ourselves.

15. We require a high degree of predictability in the businesses in which we invest due to the highly concentrated nature of our portfolio.

If you are going to enter the world of investments, remember that you must learn to anticipate your movements.

16. Our job is to find great deals.

Businesses that are profitable in the future.

17. What matters is what you do when you make a mistake.

especially if you take it as a valuable lesson or an excuse to stay down.

18. I think most investors over-diversify because they are lazy. They haven’t done enough research on any of their companies.

Not all investors have a successful future.

19. Our long-term objective is to capitalize our capital at a high rate of return and minimize the risk of permanent capital loss.

One of your goals to conquer.

20. What the market tells you in the short term is what a certain subset of people believe. That doesn’t mean they’re right.

Things are constantly changing, even in the stock market.

21. I think a very good system in a world with many passive investors is one in which there are at least a few entrepreneurial investors, prepared to speak their minds.

Risky people are always needed.

22. Herbalife: The customers are fictitious, the business opportunity is a scam, the college degree is a fraud.

Speaking loudly about the scam of this company, which sells fake products to its customers.

23. If you look at the greatest frauds of all time, Enron had that phantom trading floor.

Fraud is the most frequent threat in business.

24. I think the reputation of the hedge fund industry has gotten worse, this dog eat dog thing.

This occurs due to the excessive ambition of some who only seek their own interest.

25. If you think about the typical Herbalife distributor and their level of sophistication, to this day I still don’t understand the marketing plan – true story.

The biggest problem with this company, its dishonesty.

26. We estimate that our typical holding period will be long-term, typically four years or more.

It is over the years that the fruits of investments can be perceived.

27. If you are investing for the long term, you will want to invest in businesses that have very little debt.

Valuable advice when putting our money into something.

28. We generally invest in very good companies that have lost their way. And with better management, enormous value can be created.

Great value can be found in a lost company.

29. I say exactly what I think. Sometimes it rubs people the wrong way.

Not everyone is willing to hear the truth.

30. From day one, I was never afraid to ask someone to invest.

Self-confidence is a fundamental factor when entering this field.

31. They haven’t done enough research on any of their companies. If they have 200 positions, do you think they know what’s going on in any of those companies right now?

It is always wise to invest in companies that you know completely.

32. It is safer to invest in businesses that are not controlled.

May they give you a good handling opening.

33. Do your own research and get a good understanding of the business.

You can’t go straight into a place you don’t know.

34. I am going to the end of the earth; he had a moral obligation.

Without fear of unmasking fraudulent companies.

35. Look for very high quality businesses. What we describe as dominant, simple, predictable, free cash flow generating businesses.

The types of businesses that work the most in your favor as an investor.

36. Invest in businesses you can understand.

If you are in a company that you do not understand, you will not be able to contribute anything good.

37. It could be a great business that has done very well for a long period of time, but if you pay too much for it, you won’t get a good return.

We must also be cautious with the amount of money we want to offer.

38. You want a company that is fairly immune to what’s happening in the world.

That feasible solutions can be found for different problems.

39. There are very few large investments at any given time.

The flow of growth varies depending on the period we are in.

40. You want a business you can own forever.

That provides good profitability and stability.

41. Invest at a reasonable price.

Let it not make you lose, but let it be enough to keep everyone satisfied.

42. If you can’t predict cash flows, you don’t know what you’re worth. If you don’t know what it’s worth, you can’t invest.

Predicting the values of a company is essential to being a good investor.

43. He thought that while capital was a commodity, good investment ideas were rare assets.

There are ideas that can become prosperous businesses in the future.

44. You have to make sure that the management and people who control the business think of you as the owner and will protect your interests.

If they inject capital into a company, you are part of its management.

45. What motivates people to succeed? Sex. People don’t like to admit it, but it’s the prime mover.

Sex is a fundamental part of us as people.

46. They overcome certain hurdles before they can be listed and the shares are liquid, so you can change your mind if you want to sell.

What you need to know before selling.

47. The best businesses are those that do not require a lot of capital to reinvest in the company.

Where human talent is given more value.

48. McDonald’s untold secret is that when you sell a restaurant to a franchisee, sales usually increase a lot because the franchisees do a better job running the store.

That is why franchises are more present than other businesses.

49. The President is the CEO of this business we call America.

A comparison to make us understand both roles.

50. What Herbalife has is that it has ghost or fictitious customers.

People who get paid to lie about their fictitious benefits.

51. It is a certainty that Herbalife is a pyramid scheme.

A common scam that tries to reinvent itself every day to attract people.

52. Investing is one of the few things you can learn on your own.

A self-taught investor is one who can learn from the lessons of those higher up.

53. Ultimately, investors are only as good as their track record.

Especially about the things they can learn from their past.

54. It is how you deal with adversity that determines your ultimate success.

You will certainly not be able to improve yourself if you are in a constant comfort zone.

55. One of our lessons from past mistakes is to act promptly when we discover new information about an investment that is inconsistent with our original thesis.

Know how to wait for results but act quickly when something needs to change.

56. I have more money than I need. I don’t need to work to earn a living. I do this because I love what I do.

The point where many of us want to reach.

57. I am a very simple person.

Humility should never be lost, because it is what maintains our humanity.

58. Let me win? That doesn’t exist in my house. Nobody lets anyone win. Fight to the death.

A selfish path where the cleverest wins.

59. You should surround yourself with people who believe in you, in life and in business.

Be with people who motivate and support you.

60. You want a business where it will be difficult for someone tomorrow to set up a new company to compete with you or put you out of business.

A business that makes people prefer the original product.

61. Humility comes from mistakes.

To know that we are human and we cannot control everything.

62. I want to have one of the best investing records of all time, why not?

A professional and personal goal.

63. I work on behalf of investors I like and want to do well for. I am a competitive person.

Which motivates Ackman to pursue excellence.

64. We invest in accordance with a strategy that makes the need to rely on short-term economic or market assessments largely irrelevant.

Placing the highest value on the hope of future growth.

65. Why not own the best 10 or 11 investments, instead of the 12 to 25 ideas?

As a recommendation, Ackman advises us to aim for interesting and profitable ideas.

66. Invest in listed companies, listed companies. Because? Because those businesses tend to be more established.

The businesses where you prefer to invest.

67. If I think I’m right, I’ll take it to the end of the world until I’m proven right.

Never give up on your goals.

68. Investing is something where you have to be purely rational and not let emotions affect your decision making, just the facts.

Impulsivity is the worst enemy of every investor.

69. You want companies to have what people call barriers to entry.

What we need to look for in companies.

70. Prepared to propose a change in management, a change in strategy, a change in costs. structure, capital structure.

The kind of people that are often needed in the investment world, to stay in line.