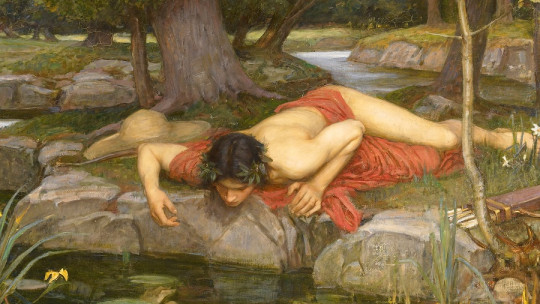

Antonio Machado said: There is no greater fool than the one who confuses value with price It seems that, in our contemporary world, something similar happens. Everyone knows the real estate bubble that caused, in part, the 2008 crisis; In a capitalist world, the art market was not going to be any less. However, is there really a bubble in the art market?

Linked to this, other questions arise. It is clear that the great fortunes that invest in art, for the most part, invest in what for them is a market product. Do they appreciate the art they bet on or do they simply use it like someone buying shares in a company? And, even more worrying, what do these investors do to support the prices of the artists they protect?

In this article we are going to talk about whether there really is a bubble in the art market and how this whole mechanism of speculation, supply and demand is maintained.

The contemporary art market bubble

Throughout the history of art, works have been valued by aesthetic, symbolic or technical criteria. Nowadays, however, it is the price that determines the value of an artist , which links with Machado’s magnificent phrase that we presented at the beginning. We ask ourselves, therefore: Is value equal to price?

This phenomenon is especially notable in contemporary art, in which great fortunes invest in living artists as another market value. To do this, many investors protect the prices of the works of these artists, bidding themselves at auctions so that the price of their work increases.

In this way, they ensure that the creations of these artists are revalued in an artificial way; That is, its value increases based on the price. All of this creates a situation that is difficult to sustain, in which art is locked into an ascending scale of prices that only a few can afford. In other words, the art market is highly elitist It should be like that?

The lucrative monopoly of art

There are international laws by which a single owner cannot have more than a certain percentage of an existing product on the market. Through this legislation, the global economy is protected and monopolies that can exclusively control the production and sale of the same product are avoided. However, in the art market this is not the case.

There are no laws in this regard, and this legal loophole makes it easy for many investors to have in their possession a disproportionate amount of works by a certain artist , so they can control, for their own benefit, the purchase and sale of the rest of their works. A complete monopoly, wow.

For example, if a tycoon owns X amount of works by an artist, it is clear that his main interest will be to increase their price in the market. To achieve this, these great fortunes often use procedures to achieve their objective that, although legal, are “unethical”, such as the one we mentioned above. Thus, through bidding at auction, these protectors ensure that the price of their protected person is suitably high so that their interest in the art market does not decline.

The notorious case of Van Gogh’s Lilies

In 1987, Sotheby’s auction house auctioned the work Lilies by the painter Vincent van Gogh. In principle, the logical thing would have been for the painting to have sold for 25 million dollars, which was the maximum price offered. But, in order to artificially increase the price, The auction house lent $25 million to another bidder to obtain the work, which finally sold for $53 million

With this action, Sotheby’s charged a commission that doubled the amount it would have received if the loan had not been made. The state of New York investigated the case and, since then (and as far as is known) this type of dubious ethical practices have not been carried out again.

Art as an investment product

Around 2006, some Russian magnates and large oil fortunes entered the art game, which skyrocketed the prices of contemporary art even more. Consequently, the art bubble reached its zenith… but it did not break. According to Artprice, the price of contemporary art increased by 800% between 2003 and 2008 and, when the credit crisis hit that last year (the crisis that shook the real estate market, among others) the art market seemed unfazed. What was this phenomenon due to?

The rise of the art market is causing prominent artists to create repetitive and commercial works without a clear conceptual or technical meaning Increasingly, art protected by the market has become an investment product, and many artists enter the game for the enormous economic benefit it brings them. The question is: what will this market art look like in the future?

A unique moment in history?

In the 1870s, the artists who were successful were the academic artists. If we ask the reader how many of these artists he knows, his answer will probably be quite limited. However, the impressionist artists who were emerging at that time exhibited their works in the salon of artists rejected by the official Academy.

If we ask, in this case, about the artists of this movement, the answer will be much broader, which shows that the historical perspective changes the criteria for evaluating artists and their creations.

In the future, which artists will be found in art history books? Those artificially elevated by the market as a speculative model of the society of our time or the current creators who, on many occasions, need to combine their art with other work to make ends meet?